Today, the President signed into law the Coronavirus Aid, Relief and Economic Security Act (“Cares Act”), which provides non-recourse loans of up to $10,000,000.00 for eligible businesses which continued to pay salaries and other business expenses during the period between February 15, 2020, and June 30, 2020 (the “covered period”). The loans are provided by third party private lenders and require no loan fee, no personal guarantee, no collateral, and carry no prepayment penalty. Below is a summary of some of the other salient provisions of the Cares Act:

Eligibility

Businesses are eligible for a loan under the Cares Act if:

• The business has less than 500 employees or is otherwise designated a small business by the Small Business Administration;

• The business was in operation before February 15, 2020;

• The business paid employee or independent contractor salaries and payroll taxes during the covered period; and

• The business certifies that (i) the current conditions necessitate the loan, (ii) funds will only be used for an allowable use, (iii) it has no duplicative loan under the Cares Act is pending, and (iv) it has received no duplicative loan under the Cares Act.

Allowable Uses

Loans under the Care Act may be used for the payment of:

• Payroll costs;

• Payment of any mortgage interest;

• Costs for continuation of group health care benefits during periods of paid sick, medical, or family leave;

• Insurance premiums;

• Sales commissions or similar compensation;

• Rent;

• Utilities; and

• Interest on any other debt incurred before the covered period.

Interest Rate

The interest rate may not exceed 4% APR.

Term

The term may be up to 10 years.

Loan Deferment

Requires lenders to provide complete payment deferment relief for at least 6 months, and up to 1 year.

Loan Forgiveness

Loan proceeds are eligible for loan forgiveness in the amount equal to the sum of: (i) payroll costs during the covered period for employees and independent contractors with a prorated salary of less than $100,000.00, (ii) rent costs during covered period, and (iii) any utility payments made during the covered period. The amount of loan forgiveness may be reduced, however, to the extent that there has been a decrease in staff or a greater than 25% reduction in wages for any employee making less than $100,000.00.

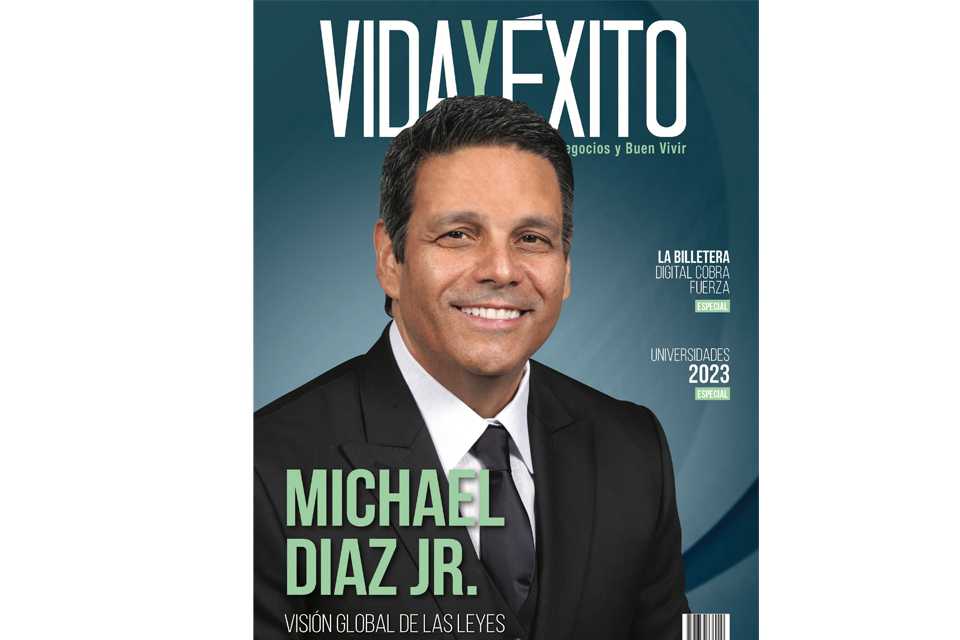

YOUR SOURCE FOR LEGAL SERVICES REGARDING THE CARES ACT

The COVID-19 pandemic has caused unprecedented disruption to business in the U.S., with small businesses being among the hardest hit. While the Cares Act represents a welcomed beacon for those small businesses, having trusted and informed counsel to help navigate its provisions is essential in leveraging all the benefits available to your business. Diaz, Reus & Targ, LLP has a team of attorneys dedicated to understanding the resources available to small businesses under the Cares Act, and the strategies which may be employed to ensure maximum benefit to clients.

Please contact us if we can be of any assistance.

![Especial abogados Salón de la Fama[61] 4](https://diazreus.com/wp-content/uploads/2023/06/Especial-abogados-Salon-de-la-Fama61-4-pdf.jpg)