Is Peru Winning the Fight Against Financial Crimes?

Q: Peru’s government announced in November that it was strengthening the country’s Financial Intelligence Unit in an effort to crack down on money laundering and crimes related to terrorism. The agency will now be able to request that judges lift bank and tax secrecy provisions when necessary and will also have broader authority to supervise individuals and organizations such as notaries, credit unions, and travel agencies. How big is Peru’s problem with money laundering, and will the new measures be effective in fighting that crime? How successful have Peru’s past efforts to crack down on financial crimes been? What are the most important vulnerabilities in this area that Peru still must tackle?

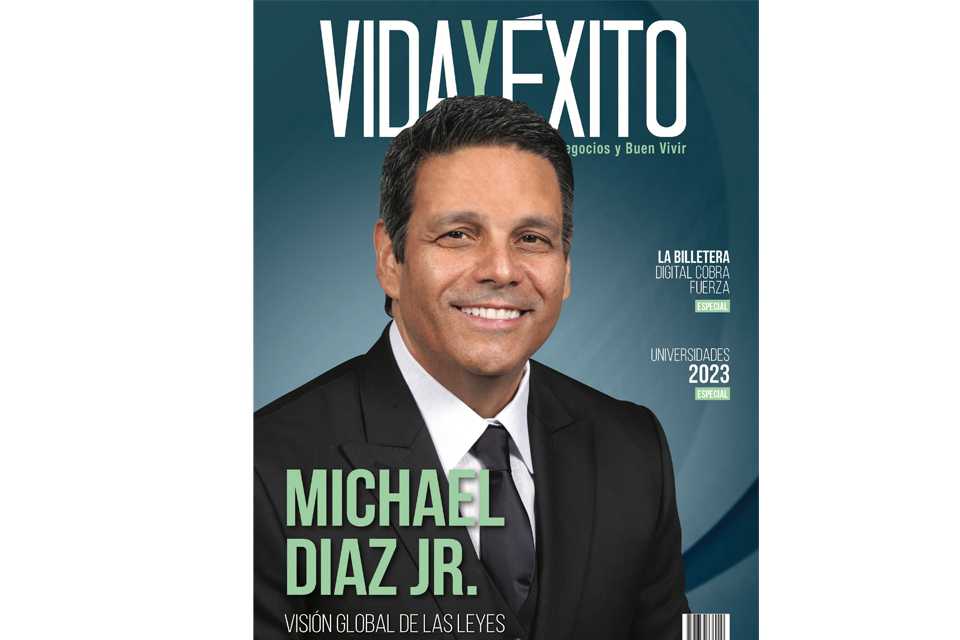

A: Fernando Castañeda, partner at Diaz, Reus & Targ LLP, Lima Office – Aramburú Castañeda Boero Abogados:

“Through Legislative Decree Number 1249, the Financial Intelligence Unit will be strengthened by creating new subjects required to report suspicious money laundering operations, for example; credit- and debit-card processing companies, as well as lawyers and accountants who routinely carry out financial advice or corporate services on behalf of a third party. The supervision of real estate agents is also assigned to the Financial Intelligence Unit, as are travel and tourism agencies, lodging establishments, mining companies, lottery games, and the like. In addition, the unit will have access (through a judge) to tax and banking secrets and will be able to share information with the prosecutor’s office about intelligence on crimes, such as kidnapping, extortion, and corruption, that they detect in their investigations. It is estimated that between January 2007 and March 2016 approximately $13 billion in assets from illicit drug trafficking (42 percent), illegal mining (34 percent), and crimes against public administrations (7 percent) were laundered, according to ASBANC. The expansion of powers described and the creation of the Centralized Organization for the Prevention of Money Laundering and Terrorist Financing can improve on the results of the past. At the same time, however, it is necessary to promote the formalization of commercial transactions in the country, and the presence of the state in the areas where informal mining is developed and drugs are produced and marketed. Only the cooperation of Peru’s executive, legislative, and judicial branches of government in eradicating corruption, money laundering, and terrorist financing will produce real changes.”

![Especial abogados Salón de la Fama[61] 4](https://diazreus.com/wp-content/uploads/2023/06/Especial-abogados-Salon-de-la-Fama61-4-pdf.jpg)