Though it has navigated the global slump in oil prices better than some of its neighbors, Colombia’s economy has still not been immune, as shown by indicators including slowing business volumes.

Latin America Financial Services Adviser asks: Will Colombian Banks Thrive in the Months Ahead?

How are Colombia’s current economic conditions affecting the country’s financial services sector? How has the central bank’s interest-rate tightening cycle affected banks? What are the biggest challenges Colombian banks face, and what strategies should the CEOs of Colombia’s banks be considering in order to thrive in the years ahead?

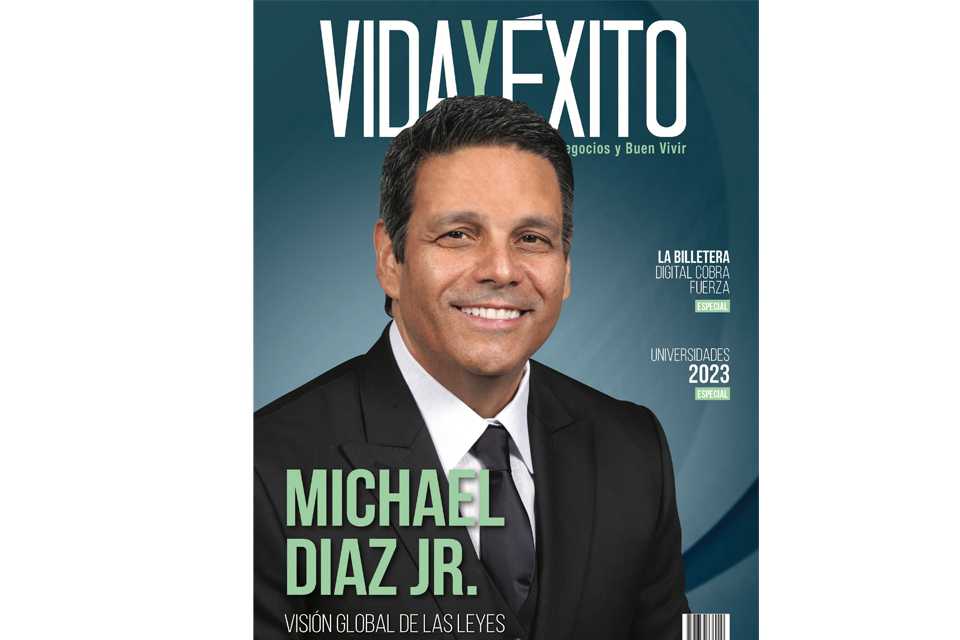

Marcela C. Blanco, Diaz, Reus & Targ LLP offers an answer:

“Despite the current economic conditions, Colombian financial institutions remain sound with regulatory capital adequacy and persistently solid supervision. Recent advances in financial regulation and supervision have further expanded their ability to respond to changing conditions. However, if the problem concerns real economy externalities, the solution is perhaps to intervene in the real economy. A financial system needs to be harnessed to deliver the transition to sustainable development. A sustainable financial system is able to integrate environmental, social and governance criteria into the investment or credit decision-making processes, and to allocate resources in projects, financial assets or portfolios with a positive impact on sustainable development challenges. Integrating sustainable financing innovation into the Colombian banking sector improves the efficiency, effectiveness, competitiveness, and resilience of the system itself.

“In this regard, the Colombian government has implemented three kinds of long-term development policies for green growth: strategic policies, operational policies and specific incentives. The strategic policies include the OECD Declaration on green growth and the National Development Plan 2014-2018, which defines a cross- cutting strategy of sustainable development. The operational policies include the ‘Institutional Strategy for the Articulation of Policies and Actions Related to Climate Change,’ which creates the National System for Climate Change (SISCLIMA) and the SISCLIMA Financial Committee. This category also comprises the Intended National Determined Contributions (INDC) and the National Green Business Plan at the Ministry of Environment. Finally, the government has developed specific incentives for green investments, such as economic incentives, tax-related incentives, and research and development incentives.”

![Especial abogados Salón de la Fama[61] 4](https://diazreus.com/wp-content/uploads/2023/06/Especial-abogados-Salon-de-la-Fama61-4-1-pdf.jpg)