Qatar is currently receiving unprecedented levels of interest from foreign investors as a result of diminished business opportunities and lower investment returns in the U.S. and Europe. Despite turmoil in other parts of the Middle East, Qatar’s economy continues to thrive. Multinationals are looking to capitalize on the region’s expanding economy, relative economic and political stability, and resilience during the financial crisis. And, although Qatar seems well positioned to ride out the current Middle East crisis, there will likely be, nonetheless, an increase in breaches of contract, more specifically; disputes will be particularly acute in the investment sector.

Against this background, Arti Sangar, Partner in Charge of the firm’s Dubai office, examines current issues affecting investment opportunities in Qatar. Although Qatar is unlikely to see disputes of the scale emerging in other countries in the region, companies should be mindful of the need to take measures to protect their investments.

In light of the turmoil in the Middle East, the overall prospects for foreign investment in Qatar look positive. Various incentives, including tax and customs duty exemptions, continue to demonstrate Qatar’s eagerness to attract foreign capital. As a result, Qatar is currently receiving unprecedented levels of interest from foreign investors. While opportunities diminish and lower investment returns prevail in the U.S. and Europe, it’s no surprise that international businesses seek to capitalize on the region’s expanding economy, political stability and relative resilience to the financial crisis.

Recently, the international media has sharpened its focus on the massive outward investment from sovereign wealth funds based in Qatar; however, investment is also increasingly flowing into the nation. The rising economy in Qatar has spurred interest from a broader class of investors to establish a presence in Qatar. In particular, the Qatari economy is positioned to steadily grow in the coming years due to their winning the right to host the FIFA 2022 World Cup. While incoming investment will be primarily used to boost Qatar’s infrastructure in preparation for the World Cup, this undoubtedly will also place Qatar in the driver’s seat, making it one of the most powerful economies in the region. And, their success will likely boost growth in the greater Gulf region.

Financial Sector.

In addition to investment opportunities in the infrastructure sector, the financial sector is looking more attractive too. Doha is home to the Qatar Financial Center («QFC»), created in 2005 and structured along the lines of the Dubai International Financial Centre («DIFC»). It currently holds some of the world’s major international financial institutions and corporations. Some foreign offices are set-up using 100 percent foreign ownership and are allowed to remit all profits outside of Qatar.

The QFC’s goal is to establish a financial services industry to support the growth of Qatar as a state, and also to act as a regional hub for foreign financial institutions. The QFC is equipped with its own financial services regulator, an independent judicial system, and specialized tribunals. It has already attracted several international financial institutions such as Marsh, HSBC, and Nexus. Qatar also recently opened its doors to foreign investment in property and construction sectors with the passing of the Foreign Ownership of Real Estate Law in 2004 easing the restriction of non-Qataris owning property within Qatar.

Emerging Markets: Careful planning minimizes risk.

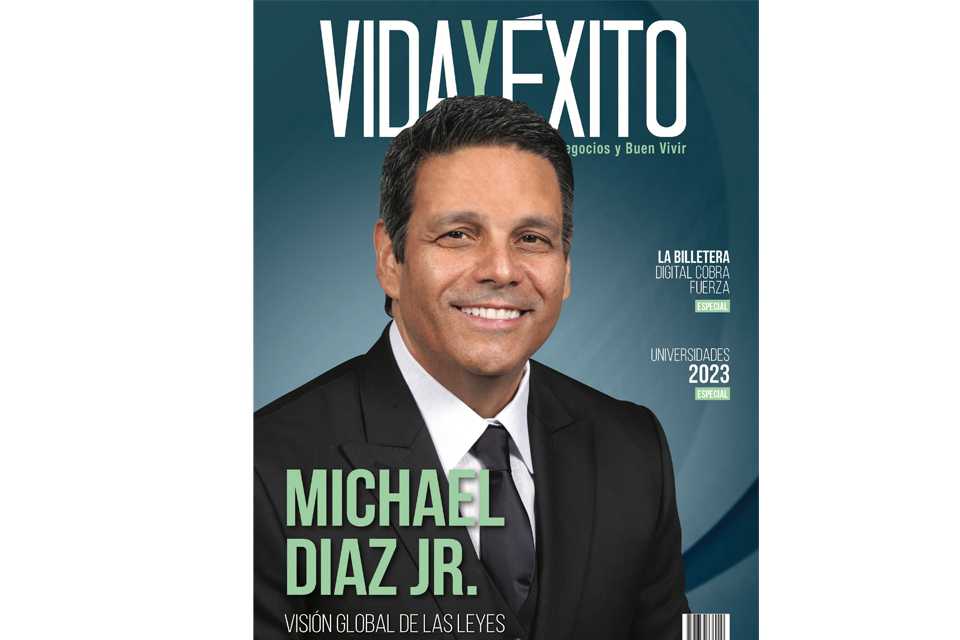

Qatar has been working extensively to form a strong and stable business environment, and the results of these efforts are reflected in the increased amount of foreign investment. Although programs of economic and legislative reforms are underway in Qatar, the region does have a distinct business culture, which can present challenges to foreign investors. And, the rapidly changing regulatory and legal environment in Qatar can also produce challenges to the uneducated investor. Nonetheless, careful planning can minimize these problems and make any investment safe, secure and profitable going forward. Diaz, Reus & Targ, LLP has represented numerous investors in emerging markets around the world. The firm ensures that its clients are well-protected through extensive due diligence, internal anti-money laundering measures, and otherwise ensuring that all contracts protect their interest in light of the regional legal framework.

![Especial abogados Salón de la Fama[61] 4](https://diazreus.com/wp-content/uploads/2023/06/Especial-abogados-Salon-de-la-Fama61-4-1-pdf.jpg)