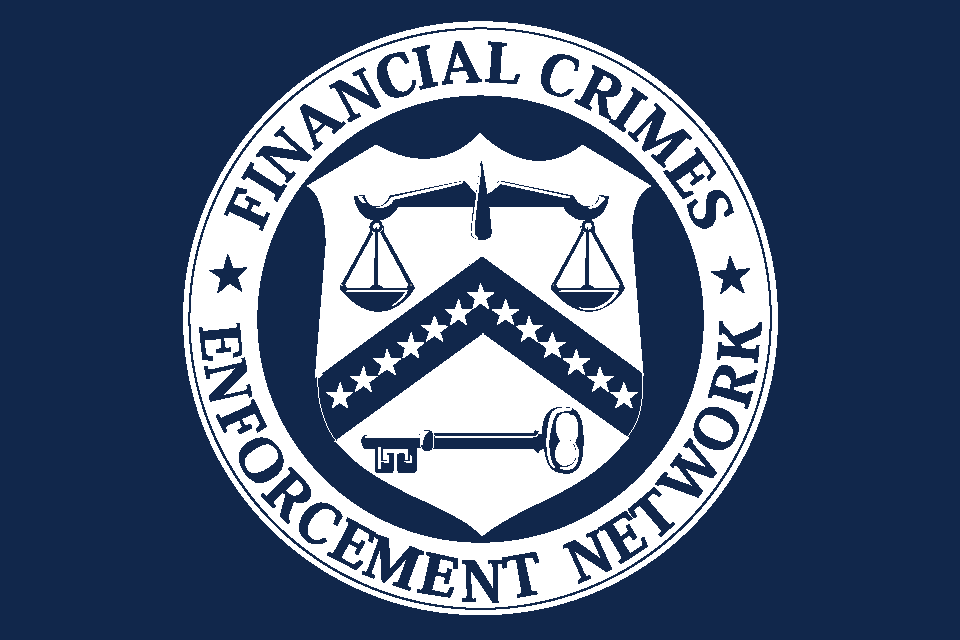

On September 7, 2018, the Financial Crimes Enforcement Network (“FinCEN”) established an exception to the obligations that banks, brokers or dealers in securities, mutual funds, futures commission merchants, and introducing brokers in commodities have under the Beneficial Ownership Rule. Particularly, FINCEN is no longer requiring these financial institutions to identify and verify the beneficial ownership information in the following cases: (1) certificate of deposit rollovers; (2) loan renewals, modifications, and extensions that do not require underwriting review and approval; (3) commercial line of credit or credit card account renewals, modifications, or extensions that do not require underwriting review and approval; and (4) safe deposit box rental renewals.

On September 7, 2018, the Financial Crimes Enforcement Network (“FinCEN”) established an exception to the obligations that banks, brokers or dealers in securities, mutual funds, futures commission merchants, and introducing brokers in commodities have under the Beneficial Ownership Rule. Particularly, FINCEN is no longer requiring these financial institutions to identify and verify the beneficial ownership information in the following cases: (1) certificate of deposit rollovers; (2) loan renewals, modifications, and extensions that do not require underwriting review and approval; (3) commercial line of credit or credit card account renewals, modifications, or extensions that do not require underwriting review and approval; and (4) safe deposit box rental renewals.

This exception, however, does not apply to the initial opening of any of the types of accounts listed above. Nor does it apply to relieve any financial institutions of all other applicable Anti Money Laundering requirements under the Bank Secrecy Act.

Info: Michael Diaz, Jr., Robert I. Targ, Fausto Sánchez

mdiaz@diazreus.com, rtarg@diazreus.com, fsanchez@diazreus.com