Join Diaz Reus attorney Michael Harris for a webinar, FEBRUARY 08, 2017, hosted by EB5Diligence, covering the tax obligations of individuals upon making an EB-5 investment and upon moving to the U.S.

EB-5 investors must file a “dual status” income tax return in the year they become a U.S. resident. Investors may need to report income from U.S. sources as a non U.S. resident and on a worldwide basis after establishing residency.

Webinar begins at 2:00pm EST / 11:00am PST. No cost to attend. Limited to first 150 attendees.

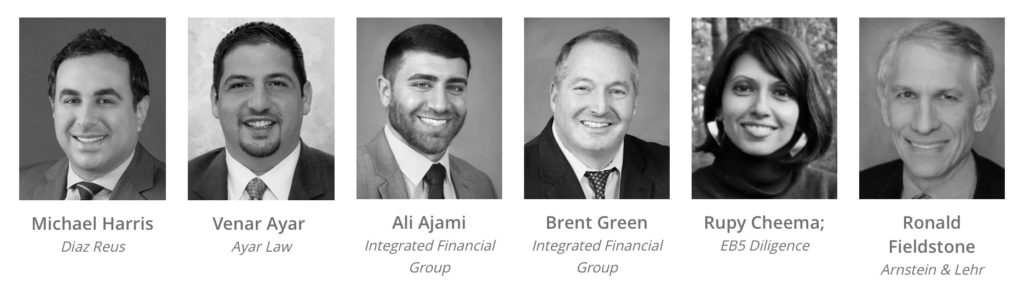

Panelists: MICHAEL HARRIS, VENAR AYAR, ALI AJAMI, BRENT GREEN, RUPY CHEEMA

Moderated by: KURT REUSS